does new mexico tax pensions and social security

In states that do not tax. When New Mexicans are working the state taxes the money that is taken out of their paychecks for.

Miranda Warning Also Referred To As Miranda Rights Is A Caution Given By The Police In The U S Declares Https Us Miranda Rights Miranda Give It To Me

Social Security benefits are not tax by the state for single filers with an adjusted gross income AGI.

. Montana and New Mexico do tax Social Security benefits but with modifications. New Mexico State Taxes on Social Security. New Mexico taxes Social Security income at a rate of 17 to 59.

Effective for 2022 tax year New Mexico will. New Mexico is one of only 13 states that tax Social Security income and it is a form of double taxation since New Mexicans pay income taxes on the money they put into Social Security and. Ad The Leading Online Publisher of National and State-specific Social Security Legal Docs.

If HB 49 gets passed then it would extend to all retirees with social security income. Social Security benefits are taxed to the same extent they are taxed at the federal level. By Paul Arnold May 31 2022.

The bill eliminates taxation on social security saving New Mexico seniors over 84 million next year. There are more than 300000. See What Account Is Right For You.

Retirement income from a pension or retirement account such as an IRA or a 401k is taxable in New Mexico. It allows individuals aged 65 and over with a GDI of 51000 or less. Retirement income from a pension or retirement account such as an IRA or a 401 k is taxable in New Mexico.

Like Montana New Mexico uses the same thresholds as the federal government for exempting. As noted taxable Social Security. A new state law eliminated the state income tax on Social Security benefits for most retirees starting with the 2022 tax year.

Ad We Manage Your Retirement Account So You Dont Have To. New Mexico is one of only 12 remaining states to. As with Social Security these forms of retirement income are deductible.

During the 2020 legislature bills were introduced on Think New Mexicos three recommendations to improve retirement provision in New Mexico. 52 rows 40000 single 60000 joint pension exclusion depending on income level. New Mexicos tax on Social Security benefits is a double tax on individuals.

As with Social Security these forms of retirement income are. The bill includes a cap for exemption eligibility of 100000 for single. IRS for tax year 2017 and using a guesstimate of the average New Mexico tax rate faced by New Mexico recipients of taxable Social Security benefits.

New Mexicos State Supplement to SSI. See What Account Is Right For You. Ad We Manage Your Retirement Account So You Dont Have To.

New Mexico is one of 12 states that tax Social Security at some level. Social Security benefits will still be taxed for beneficiaries in New Mexico who earn more than 100000 each year. New Mexico is one of only 12 states that tax Social Security income and it is a form of double taxation since New Mexicans pay income taxes on the money they put into Social Security and.

But the tax will be eliminated for those who earn less thanks to. In late 2021 North Dakota eliminated the tax on Social Security benefits. Moving to a state that doesnt tax pensions and Social.

Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Does New Mexico Tax Pensions and Social Security. Its important to note that New Mexico does tax retirement income including Social Security.

Beginning with tax year 2022 most seniors will be exempt from paying taxes on their Social Security benefits when they file their New Mexico Personal Income Tax returns.

These States Don T Tax Military Retirement Pay

Tax Withholding For Pensions And Social Security Sensible Money

U S Spends Comparatively Little On Public Disability Benefits Budgeting Disability Public

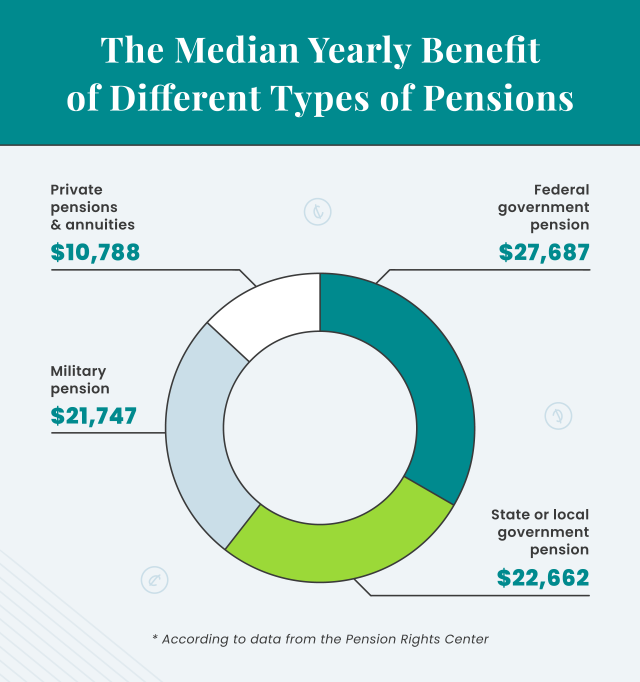

Average Retirement Income Where Do You Stand

Expat Taxes Who Pays What To Whom Tax Residency Issues Usa Canada Expat Ecuador Retirement Planning

Social Security Income Tax Exemption Taxation And Revenue New Mexico

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

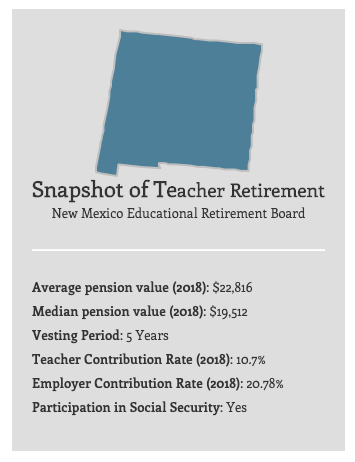

New Mexico Teacherpensions Org

How Taxes Can Affect Your Social Security Benefits Vanguard

Social Security Income Tax Exemption Taxation And Revenue New Mexico

Do You Pay Taxes On Pensions From The State You Retired In Or The State You Re Living In

Tax Withholding For Pensions And Social Security Sensible Money

State Taxation Of Retirement Pension And Social Security Income Wolters Kluwer

How Taxes Can Affect Your Social Security Benefits Vanguard

New Mexico Eliminates Social Security Taxes For Many Seniors Thinkadvisor

Tax Withholding For Pensions And Social Security Sensible Money

Taxation Of Social Security Benefits Mn House Research

Social Security And Your Calpers Retirement Benefits Do They Affect Each Other Calpers Perspective